Advantages And Disadvantages You Need To Know Before Enrolling Into Medicare Plans

The essay digs deep into a thorough study of the benefits and drawbacks of signing up for Medicare insurance. It draws attention to the many benefits that these plans provide, such as thorough coverage for necessary medical services, such as hospital stays, doctor visits, and prescription medications. Key advantages include the comfort of having access to a large network of healthcare providers and the guarantee that coverage would continue as people age. The article also discusses the drawbacks of Medicare plans, such as potential coverage gaps that can call for supplementary insurance, limited provider options in some plans, and the difficulties in choosing and enrolling in a plan. The article attempts to provide readers with the required knowledge to help them make wise decisions about their Medicare healthcare coverage by offering a balanced view of both the advantages and disadvantages.

Table of Contents

ToggleAdvantages Of Medicare Advantage Plans

1. Coverage

The wide range of medical services and therapies that beneficiaries of Medicare plans have access to are referred to as comprehensive coverage. This includes necessities for healthcare like hospital stays, surgeries, doctor visits, routine checkups, and numerous diagnostic tests. People who have comprehensive coverage can obtain a variety of medical services without having to pay the full cost out of pocket. This feature makes sure that recipients may put their health and wellbeing first without worrying about mounting medical debt all the time. Comprehensive coverage under Medicare plans meets the fundamental demands for preserving and enhancing one’s health by providing coverage for a wide range of medical necessities.

2. Standard dental care

Regular dental check-ups, X-rays to identify dental problems, and treatments such as cleanings, fillings, and even dentures when necessary are all included in routine dental care. These services are essential for preserving oral health, avoiding dental difficulties, and taking care of problems before they become more serious. It’s crucial to remember that Original Medicare (Part A and Part B) often does not cover normal dental care, including common procedures like checkups, cleanings, and dentures, even though they are essential to overall health. Because of this, people looking for complete dental coverage frequently need to consider other options, like standalone dental insurance policies or Medicare Advantage plans with dental benefits.

3. Insight Care

A variety of services are included in vision care, which aims to preserve and enhance eye health and visual acuity. In order to assess visual health, identify potential problems like refractive errors or eye disorders, and ascertain whether corrective lenses like glasses or contact lenses are required, this involves routine eye exams. It’s crucial to remember that Original Medicare (Part A and Part B) typically does not cover basic vision care, including eye tests for glasses or contact lenses, despite the fact that maintaining optimal eye health is essential to overall wellbeing. People who depend on corrective lenses or need continuing eye care as a result frequently need to look for extra coverage options to take care of their vision-related needs.

4. Care for Hearing

A variety of services aimed at determining and addressing auditory health are included in hearing care. To evaluate any hearing-related problems and establish whether therapies like hearing aids are necessary, this entails routine hearing exams. The ability to hear clearly is essential for social engagement, communication, and general wellbeing. The fact that Original Medicare (Part A and Part B) typically does not cover normal hearing care, including hearing exams and hearing aids, should be noted. For those who require auditory therapies to improve their quality of life, this coverage gap is a problem.

5. Prescription Drug Coverage

The inclusion of drugs in a healthcare plan’s benefits is referred to as prescription drug coverage. This coverage includes the price of numerous prescription medications that people may need to treat their medical issues. For those with continuing medical conditions or chronic illnesses, access to affordable drugs is crucial. It’s vital to remember that Original Medicare (Parts A and B) sometimes excludes coverage for the majority of prescription medications. People frequently need to think about enrolling in separate prescription drug plans (Medicare Part D) or Medicare Advantage plans that cover prescription drugs in order to fill this gap. By clicking on this link, you can get more information at https://www.medisupps.com/medicare-supplement-plans/medicare-supplement-plan-g/medicare-plan-g-pros-and-cons/

6. Wellness Programs and Fitness Center Membership

Through physical activity, preventive treatment, and healthy lifestyle decisions, wellness programs and fitness center memberships aim to enhance overall health and well-being. These programs frequently give participants access to gyms, exercise classes, dietary advice, and health checks. Participation in such programs, especially by older persons, can improve health outcomes and quality of life. It’s crucial to remember that Original Medicare (Parts A and B) frequently does not pay for wellness programs or gym memberships, forcing people to look for other options to engage in fitness and preventive care.

7. Opportunities to Cost Prices

The term “cost-saving opportunities” in the context of healthcare plans refers to a variety of policies and features intended to ease the financial burden of medical costs on individuals. Lower premiums, cheaper services, negotiated prices with healthcare providers, and coverage for preventative services that assist identify health issues early on and ultimately avert more expensive treatments are a few examples of these chances. It’s important to remember that healthcare expenditures can be a major worry, particularly for seniors or people with certain medical needs. Even while Original Medicare (Parts A and B) offers some coverage, people may still have out-of-pocket expenses to take into account.

Disadvantages Of Medicare Advantage Plans

1. Limited-Service Providers

When referring to healthcare plans, the term “limited-service providers” describes a situation in which patients have a limited number of options for hospitals, doctors’ offices, and other healthcare facilities. A defined network of healthcare providers with whom they have signed contracts may exist for some plans, such as Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), or Exclusive Provider Organizations (EPOs). This may affect a person’s ability to see the doctors or specialists of their choice who might not be in the network of the insurance plan.

2. Offerings of Complex Plans

The large range of Medicare plans that are available, each with its own set of benefits, coverage options, costs, and rules, is referred to as having complex plan offerings in the context of healthcare. Original Medicare (Parts A and B), Medicare Advantage (Part C) plans, Medicare Supplement (Medigap) plans, and stand-alone prescription drug (Part D) plans are among the options provided by Medicare. For people who are inexperienced with medical jargon or unclear of which plan best meets their individual medical needs and financial position, navigating these options can be challenging.

3. Costs Added to the Coverage

Additional fees for coverage are costs associated with healthcare plans that go above and beyond the standard premiums. Individuals may be required to pay deductibles, co-payments, and coinsurance when they obtain medical services, in addition to the premiums they pay on a regular basis to maintain coverage. These expenses can add up, especially for those who visit the doctor frequently or have persistent medical issues. These prospective costs have an impact on the entire financial burden of healthcare and might differ greatly depending on the plan chosen, so it’s crucial to be aware of them.

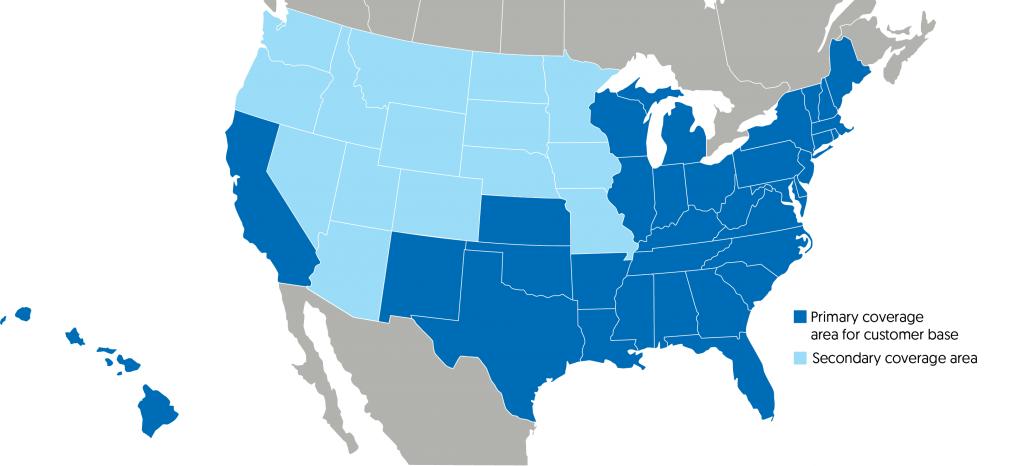

4. Coverage Specific to States

State-specific coverage in healthcare insurance refers to differences in options and benefits depending on the state where a person resides. Despite the fact that Medicare is a federally funded program, some plans, such as Medicare Advantage or Medigap plans, may provide features or prices that are unique to a particular area in order to comply with local laws and healthcare market conditions. Depending on the state of domicile, this may lead to variations in the plans that are offered, their prices, and their covered services.

Conclusion

When traversing the intricate Medicare plan environment, it becomes clear that there are both considerable benefits and potential negatives that people should take into account before enrolling. The benefits of complete coverage, which includes a range of medical services, prescription medications, and even wellness benefits, can offer priceless peace of mind and improve general wellbeing. The need for rigorous examination is highlighted by the possible drawbacks, which include a lack of service providers, coverage gaps for dental, vision, and hearing care, and the complexity of plan options. Making informed choices is essential, and the range of options available, state-specific factors, and additional fees only serve to highlight this. People may ensure a healthcare future that provides complete coverage and peace of mind by considering the benefits and drawbacks.